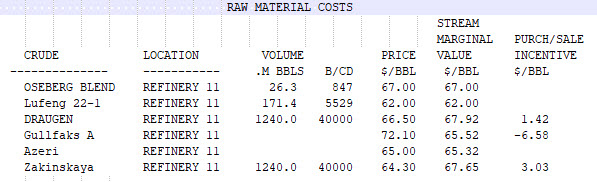

If the price of a crude is less than the marginal value, why doesn’t it buy more? Here is an optimal solution to the volume demo model -with a few extra crudes added – to illustrate the relationships between price, stream marginal value and incentives.

The volumes of the first two crudes have balanced at the point where the marginal value of the stream, the income that could be made from having a free extra barrel to process, is equal to the price. This is exactly what is expected when the amount is not being limited by a constraint. (See Note #37 Stream Marginal Values.) There is no incentive to buy more or less because the overall profit would go down.

The next two crude purchases have incentives. The stream marginal values differ from the price. Draugen has hit an upper limit (a nice round number is usually a good clue). There is a positive incentive. Even if you had to pay for another barrel, there is still money to be made, equal to the difference between what you would pay and what you would gain. Gullfaks has a negative incentive. It is at a lower limit. The price is more than the value even for the first barrel so none is bought. The incentive is again the difference between the price and the marginal value and is how much the price would have to go down before any was bought.

The final crudes, however, don’t fit the pattern. The marginal value of Azeri is higher than the price, yet it none is bought and no incentive is shown. Zakinskaya might look to be like Draugen as it has clearly hit an upper limit, and has a positive incentive, but if you check the value it is lower than the difference between price and value. The marginal value is actually 3.35 greater than the price, so the reported incentive is 32 cents short. Which just happens to be the difference between the price and value of Azeri. What is going on?

The incentive in the report is not simply the difference between the price and marginal value. It is the shadow price for the variable which represents how much of the crude is bought. That is pretty much the same thing as the marginal value on a constraint as it gives you the change in cost for a one-unit change in that variable in the solution. It will be equal to the difference in price and marginal value when the only active constraint on the purchase is a bound on that single option. When the incentive does not equal the difference between price and marginal value, it means that another constraint restricts your ability to benefit from buying more (or less if the value is above the price).

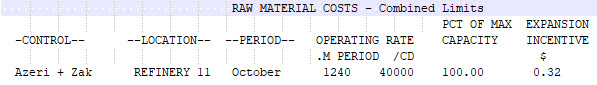

In this case, I had controlled the sum of Azeri and Zakinskaya, imagining some restriction on the jetty capacity for crudes arriving by ship from a particular region.

This limit is at its maximum and there is our missing $0.32. There is no benefit in being allowed to buy another barrel of Zakinskaya because even if the maximum on the purchase was relaxed, this other limit would keep it at 40,000 per day. There is equally no incentive to buy more Azeri because you would have to back off the other more valuable crude. (There is no negative incentive because you are not forced to take the purchase opportunity – you would just ignore it.) However, if the constraint on the sum of the two purchases was relaxed another barrel of Azeri could be bought. So the incentive on the combined limit is equal to the difference between the price and value of Azeri as that is the next best available option.

Adding additional contributors to the group or other constraints would complicate the situation further, so these relationships will not always be so easy to work out. But, whenever you see an incentive that is not equal to the difference between price and marginal value, you will know that something else is controlling the feasible amounts. You can look in the MTX file or use the Matrix Analyzer to find any extra connections the purchase (or sales) vectors have.

7th May 2019.

Comments and suggestions gratefully received via the usual e-mail addresses or here.

You may also use this form to ask to be added to the distribution list so that you are notified via e-mail when new articles are posted.